Written by Leigh Schaller

Recently two South African insurance giants brought out extensive reports diving into how they think about ESG, including a survey of the top 40 JSE companies and their ESG approach.

Key takeaways

- Companies can’t afford to ignore ESG

- Investor concerns are driving ESG

- Adhering to legislation is not a driving factor

- South Africa is lagging in terms of ESG reporting

Recently insurance giants Sanlam and Old Mutual each published reports focusing on the ESG landscape.

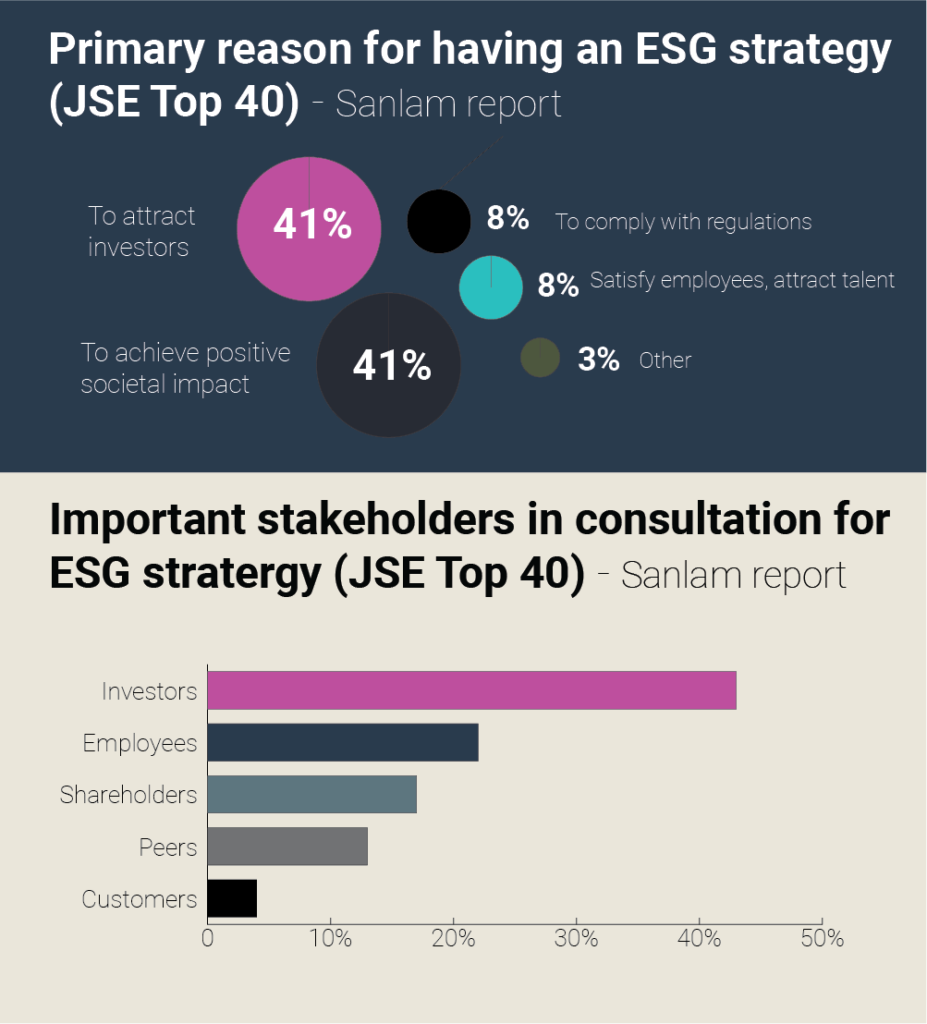

The Sanlam report included a detailed survey it commissioned of the top 40 companies on the JSE. A key finding concerned the importance of ESG in attracting investors. Respondents list it as the joint top reason for having an ESG strategy.

Forty three percent of those surveyed also listed investors as the most critical stakeholders in consultations around ESG.

Old Mutual, a significant investor in many companies, gave a window into how it thinks about ESG from a shareholder perspective in its report.

It takes Sasol, one of its 53 investee companies to task, “Sasol is the single biggest emitter of carbon emissions in the South African listed market. While it is a large employer and a key contributor to South Africa’s gross domestic product, we remain concerned about the long-term implications of its climate impact and its stranded asset risks. We feel the company has failed to communicate a clear strategy that would resolve or improve its current climate metrics and carbon emissions.”

Difficulties with ESG Reporting in the South African context

The Sanlam report also pointed out concerns with the current ESG landscape, quoting Brett Wallington of MD of Paragon Impact.

“Imagine accounting, if we didn’t have a standard way of measuring accounting so anyone could label something as an asset or a liability on the basis of a whim.” Wallington notes that South African companies used to be leaders in integrated reporting and reporting on sustainability data but have fallen behind the Europeans.

He notes the difficulties for many smaller companies trying to stay afloat have with the ESG reporting burden.

“The reality is that it is mostly the big guys with big capital behind them – like the Old Mutuals of this world and the banks that are the leaders in this space. But the dilemma that the survivalists face, he adds, is that ESG is going to become increasingly essential for any organisation aspiring to global competitiveness. If you don’t get on the train you’re simply not going to qualify to do business with the large European and British companies,” says Wallington.

Old Mutual notes that it’s thinking of ESG not only from an investment perspective but increasingly from an insurance point of view.

“The topic of emissions accounting and decarbonisation and, more recently, net zero targets has been primarily assessed and addressed from the perspective of investment and lending portfolios – not insurance underwriting portfolios,” notes the Old Mutual report.

“However, in the last few months, a light has been shone on insured assets and activities and their impacts on the environment and society.”

ESG concerns are creeping increasingly into CFOs’ agendas, even at smaller companies. A recent CFOClub podcast highlighted how Neopak’s financial director grapples with ESG.

CFOClub Africa offers an ESG reporting license to assist CFOs with limited resources in developing an ESG strategy and reporting framework.