‘It’s either adapt or die, so that’s why we continue to learn’

Welcome to this SAIBA CFO podcast, SAIBA is the South African Institute of Business Accountants, it has more than 12 000 members in the country and specialises in a wide range of disciplines such as accountancy and tax, training and development, career enhancement, legislation, designations, recognition and financial reporting.

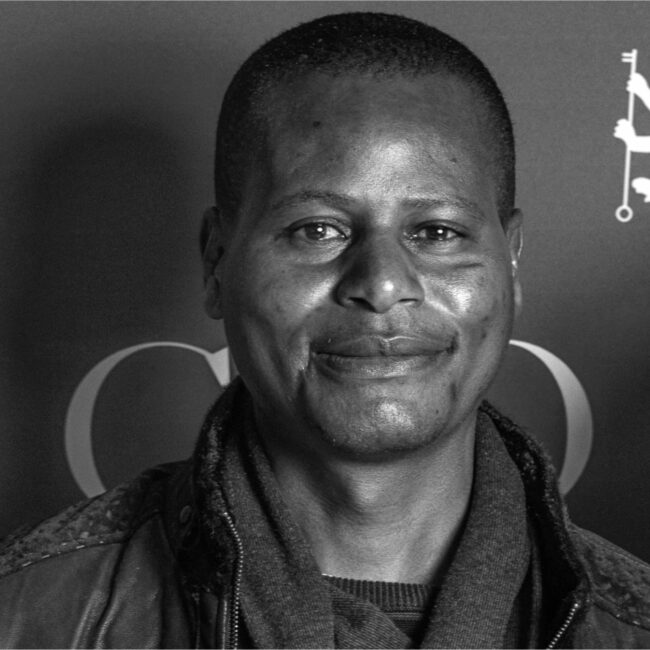

My guest today is Ishe Moyo, he’s the CFO and Financial Director at Afrimedtech, it is a company which markets medical equipment and services to public and private hospitals. He has a very impressive CV, apart from having several SAIBA certifications related to business rescue, assurance services, immigration, tax and non-profit organisations, he’s also a certified forensic accountant and risk management consultant. He holds a Zimbabwean accounting qualification, which is similar to a chartered accountant qualification in South Africa. He also has an MBA and, believe it or not, he’s still studying, he’s currently busy with a master’s degree in big data and business intelligence.

Ishe, thanks so much for joining us, you clearly like to study.

We are living in an evolving world, everything is changing every minute, whether it’s due to legislation or it’s due to politics, everything is changing. So we need to keep in touch and we need to be up to date. From a CFO perspective, I call it a chief future officer, this is someone who has to have the insight and the foresight to look into the future. So that’s why it’s important to continuously learn and that’s why I’m glad that SAIBA is always at the forefront when it comes to CPD. It’s either adapt or die, so that’s why we continue to learn.

You are currently studying towards a master’s degree in big data and business intelligence, that is a very specialist field, how do you think this qualification will assist you as a CFO?

We’re talking about CFOs and financial executives here and if you look at the traditional role of a CFO, we’re looking more at a broader perspective, we’re looking at technology, a CFO must be able to understand systems, that’s the way to go.

As a CFO I must be qualified in these things so that I can bring it to the board and it’s something that I have hands-on experience with., something that I’m able to articulate to the board.

You are currently CFO of Afrimedtech, tell us about the business.

We are more into medical equipment supplies and when we started off, we saw a gap, we discovered that most of the equipment in public hospitals was lying idle and not being used and we saw that as a gap and said why don’t you repair this equipment. We saw it as an opportunity and said let’s repair this equipment.

We started at public hospitals but now we are drifting away from the public sector because sometimes due to where the equipment is, you’ll be given a list of hospitals in Mpumalanga and there’s no details about the hospital, it’s difficult to get in touch with the authorities there. So that was one of the nightmares and then, of course, the issues when it comes to payment. It was just a bad experience.

You’re not only the CFO of Afrimedtech, you also hold an executive position at AccountPro Consulting, as well as a real estate company, Home of Realty, where do you get time to be involved in so many businesses?

In finance, as a CFO, we look at investments, which led to me getting interested in property, so I’m also a qualified estate agent and also as a principal. So for you to be able to invest in these things, you not only need to be familiar with it but you also need to be a team player. So that’s why I got interested in so many things.

When did you decide that you’d like to have a career in accounting and become a CFO?

I grew up in Zimbabwe and I had an interest in accounting from the beginning and I did well academically. I think I did so well that the government took notice of it, I think at one time it was the public sector organisation and management, and then I was invited to the army. The army was recruiting specialists like doctors and accountants. That’s when I joined the army as a specialist, and I went for the cadet training and that is where the military commanders are trained. I did well there and I was deployed straight away when the war started in Congo, I think I was one of the youngest commanders. So after Congo is when I came back and I was appointed as chief accountant for defence.

The role of the CFO has changed significantly over the years, what do you believe are the core roles of a CFO in a modern company today?

It has drastically changed, we talk about the four roles of the CFO, the traditional roles, the stewardship, the operations, the catalyst and strategies. But now we are evolving, there are new issues coming on board like ESG. As CFOs our roles are broadening, our roles are changing every day, they are evolving.

Do you think the evolution of the CFO role stems from education or just the way business has changed over the past decade or two?

It stems from the way business has changed, we’re talking about changes in terms of legislation, the environment and politics, so it’s impacted by a lot of changes. We are drifting from the traditional roles and we have to adapt to an evolving role.

Ishe, you hold several qualifications from SAIBA, why did you choose SAIBA and what value does it add to your role as a CFO?

What we want is value, quality and personal development. I look at the other bodies and SAIBA is always ahead, SAIBA is always innovative and SAIBA is always leading when it comes to this space.

So you want to join the best, you want to join the leaders and you want to be someone at the forefront, that’s why SAIBA is everything.

What do you think is the single biggest challenge facing CFOs in South Africa today?

I think the biggest challenges are human resources and technology advancements. In South Africa it’s an issue of human resources, we need efficient and reliable human resources and at the same time, I think we are lagging behind with technology advances. We have the equipment for the technology, but we don’t have the expertise.

The boundaries between a CFO and CEO have evolved significantly over the years, in many ways the silos have merged, what do you think are the core roles of these two individuals or positions?

I regard the two roles as hand in glove, they are inseparable, the CFO is the eyes for the CEO. Strategy formulation mainly comes from the CFO, the CFO is the catalyst, the one with the foresight, they are the future officer. So I am watching the trends, I am watching everything, changes in legislation, changes in the political landscape, changes in terms of anything to do with social contracts. I watch the trends and then I bring them to the CEO.